Market Update

Current Market Thoughts

- Year-to-date (YTD) through May 18th, large cap equity indices remain near their lows with the S&P 500 falling 17.2% and the NASDAQ Composite index falling 27.2% as the market continues to price in the Fed’s more aggressive interest rate increases to fight high inflation.

- Easy monetary and fiscal policy helped fuel strong market returns the last three years, so the Fed’s tightening is moving market valuations back in line with their historic averages. The S&P 500 traded at more than 21 times earnings at the end of 2021 but fell to 19.5x earnings as of 3/31/22. The long-term average price to earnings multiple is 16.8x earnings for the S&P 500.

- While painful, this is a healthy pull back that is correcting some of the risk-on excesses of the last few years. Corporate earnings have increased about 10% year over year through the first quarter, so the market decline is driven by earnings multiples moving closer to their historic average.

- Dividend growth stocks have generally fared better than the overall market in the recent drawdown as their defensive nature has been preferred by investors.

Cryptocurrency Market Slide Indicates a Preference for Quality:

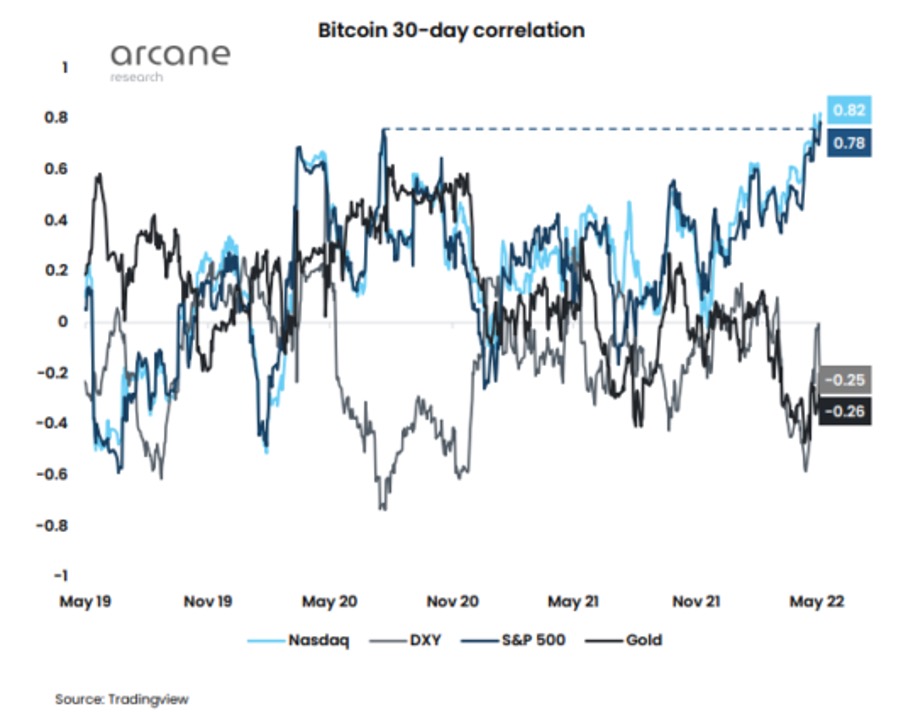

While we take no view on the speculative asset class of cryptocurrencies, Bahl & Gaynor sees the significant drawdown (and trust) in these speculative assets as a painful opportunity for investors to reassess risk appetite in their portfolio. Despite claims by crypto enthusiasts that Bitcoin, the bellwether cryptocurrency, is a store of value that adds diversification to investor portfolios because it is uncorrelated to the equity market, recent market experience proves otherwise (as the graph below illustrates). As of last week, the 30-day correlation for Bitcoin to the NASDAQ and S&P 500 benchmarks hovered near an all-time high of 0.8.

The underlying blockchain technology and certain digital currencies may hold a place in the future of commerce. Still, last week’s selloff, and the instability of the top-three “stablecoins” illustrate that the risk inherent in cryptocurrencies and other speculative assets may have been vastly underestimated by market participants due to the excess liquidity that the Fed pumped into the economy in 2020 and 2021 to fight Covid.

Bottom-Line Conclusions:

Despite the increased market and economic uncertainty, B&G is confident our focus on high quality, dividend growth companies will help us deliver on our goal of providing solid risk adjusted returns through a full market cycle.

- We tend to invest in profitable companies with growing cashflows and stable balance sheets that have financial flexibility to navigate uncertain times.

- A growing stream of dividend income provides a defense of purchasing power in high inflationary times.

- It is our view that dividend income will provide a much more meaningful portion of total return for the market over the next few years as we work through the higher-than-average market valuations and current uncertainties.

The “S&P 500” is a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Bahl & Gaynor. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Bahl & Gaynor. Income Growth is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the S&P 500.

Disclosure: Investment advisory services provided through Bahl & Gaynor Investment Counsel (“B&G”), a federally registered investment adviser under the Investment Advisers Act of 1940. Registration does not imply Information or a certain level of skill or training. More information about B&G can be found by visiting www.adviserinfo.sec.gov and searching by the adviser’s name. This is prepared for informational purposes only and may not be applicable to your particular situation or need(s). It does not address specific investment objectives. Information in these materials are from sources B&G deems reliable, however we do not attest to their accuracy. Past performance is not indicative of future results. Indices and benchmarks are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Index return information is provided by vendors and although deemed reliable, is not guaranteed by B&G. No fiduciary relationship exists because of this commentary. If you have any questions regarding the indices or investments referenced in this presentation, contact your B&G investment professional.