Our Approach

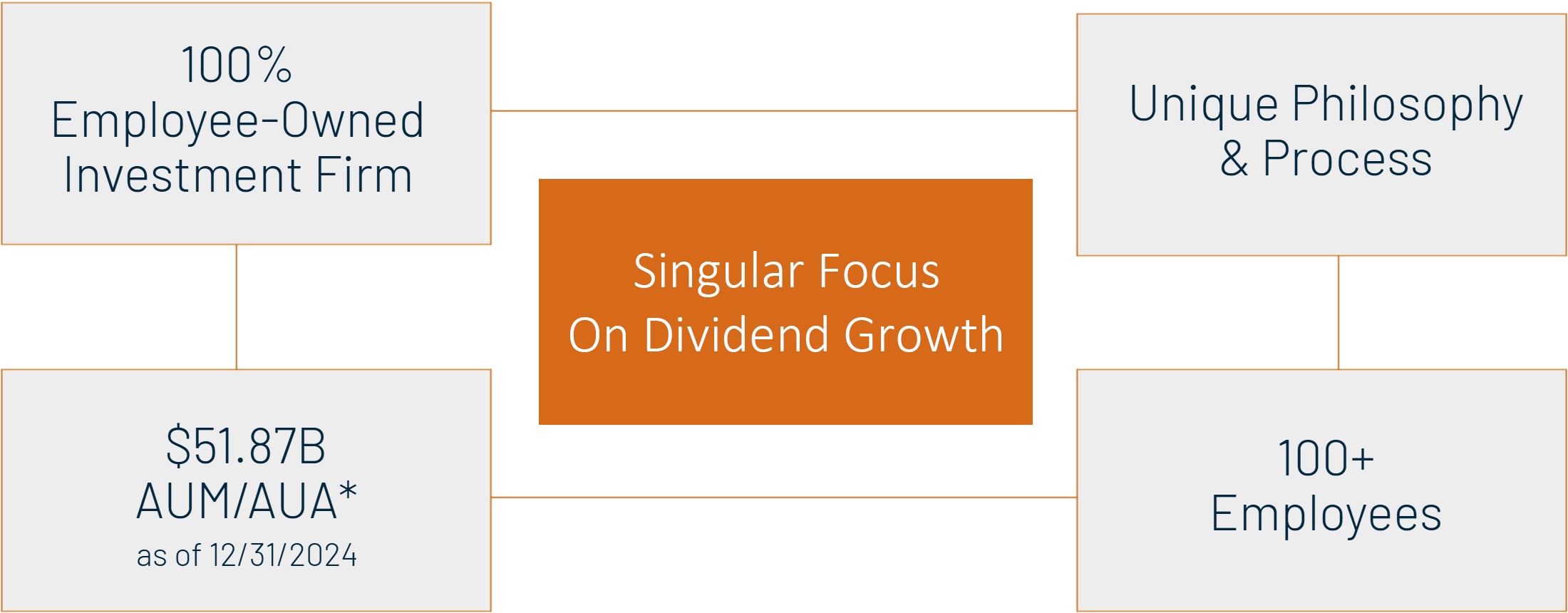

Since 1990, Bahl & Gaynor has pursued a unified fundamental investment philosophy predicated on long-term ownership of high-quality businesses that we believe are uniquely capable of compounding capital and dividends at attractive growth rates.

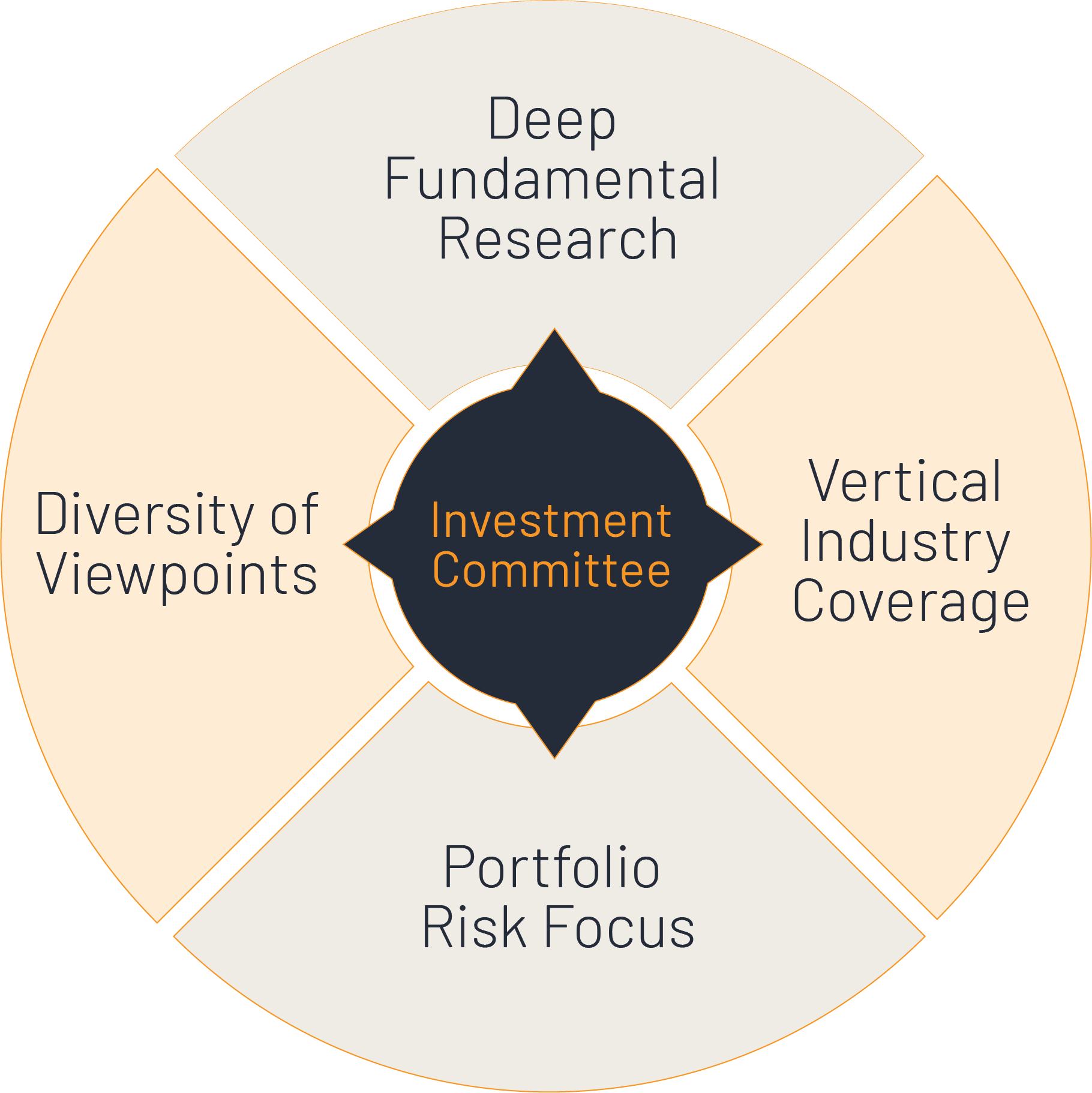

Our Process

Thought Leadership

4Q2024 Investor Letter

2024 MARKET RECAP 2024 delivered another strong year for stock investors across the market cap…

Learn MoreOur Strategies

Income Growth

Seeking attractive current and growing income with downside risk protection and strong risk-adjusted returns.

Bahl & Gaynor Dividend

Formerly Known as Large Cap Quality Growth

Seeking accelerated income growth characteristics.

smig® – Small/Mid Cap Income Growth

Applying our core income growth philosophy to small and midcap companies.

Bahl & Gaynor Small Cap Dividend

Formerly Known as Small Cap Quality Growth

Seeking attractive risk- adjusted return opportunities in small dividend-paying companies.

Our Team

Our intense depth of knowledge regarding equity income growth and downside protection as drivers of risk-adjusted return sets us apart in our industry.

Schedule a Meeting

Subscribe to our newsletter to get to know us, or connect directly with one of our experienced advisors below to learn how our capabilities can help you achieve your goals.