Bahl & Gaynor Insights

There are years that happen in weeks, and other times when weeks happen in years.

News developments around tariffs in just the first day of this week are a reminder that portfolio management should involve a measured approach to anticipated policy changes, and even enacted policy.

A pause in tariffs levied on Canada and Mexico, and a mild and delayed retaliation from China, suggest an increased probability of a negotiated trade policy outcome, though time will tell.

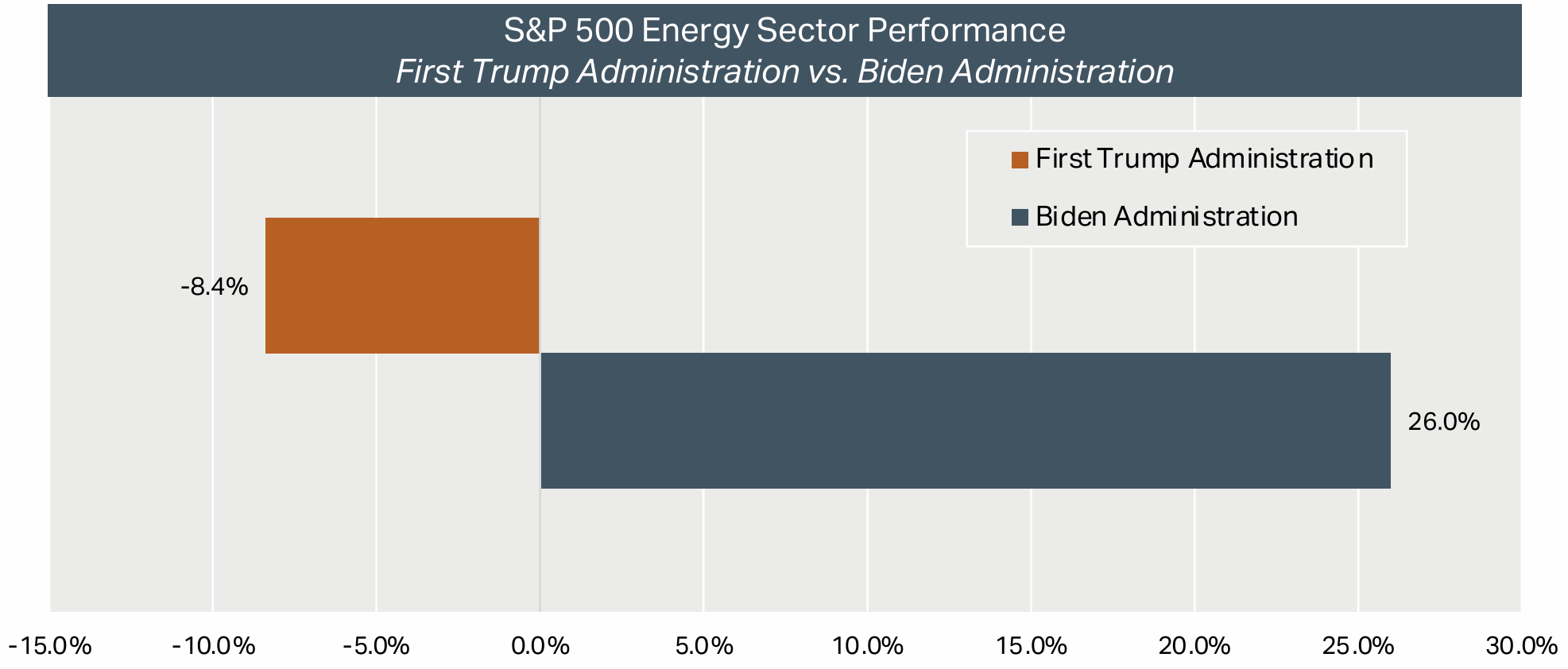

We are reminded of the S&P 500 Energy sector performance during the first Trump Administration and the Biden Administration. Despite very different regulatory agendas pertinent to this sector, the energy sector was the only negative-returning sector during a benign Trump Administration policy environment, yet the sector delivered significant gains in a more adverse Biden Administration policy environment.

Source: Bloomberg, 2025. First Trump Administration Term: 1/20/2017-1/20/2021, Biden Administration Term: 1/20/2021-1/20/2025.

BOTTOM LINE

The steady state of trade policy outcomes, and their impact on company fundamentals, is likely far from determined. It is interesting to us at Bahl & Gaynor that investors appeared much more reactive to unexpected developments around DeepSeek than well-covered trade policy news. Arriving at an ultimate trade policy resolution will likely involve further volatility. Fortunately, this is a condition our fundamental dividend growth philosophy is designed to address via our exposure to quality business models with flexibility in a variety of economic environments. Volatility is also a channel through which great businesses can become mispriced, and it is our opportunity as active managers to capitalize upon this when it occurs.

Published on 2/4/2025.

The information provided herein is for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities. The views expressed reflect the opinions of Bahl & Gaynor as of the date of this communication and are subject to change. Bahl & Gaynor assumes no liability for the interpretation or use of this report.

BGC20250204-35