Quarterly Review

A Multi-Faceted Transition is Underway

Detailed Review

Detailed Review

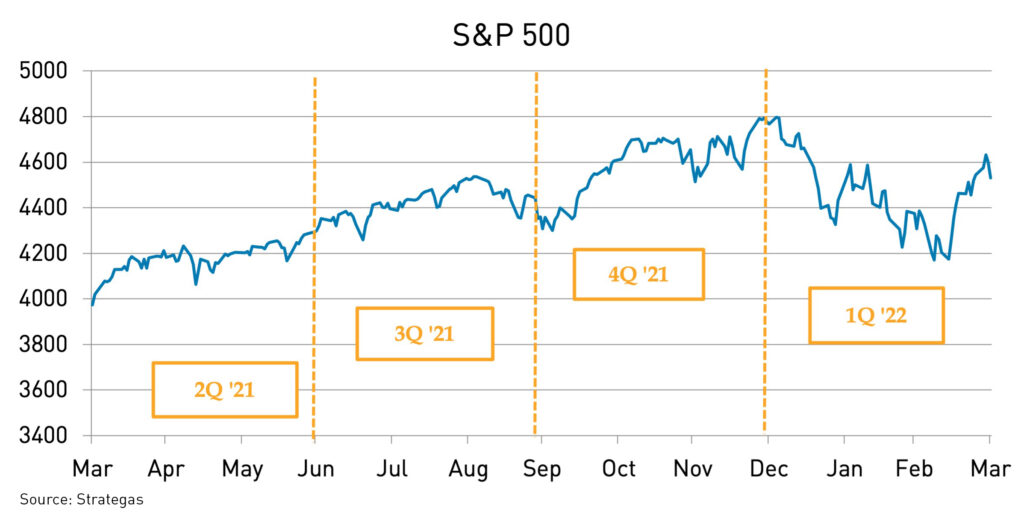

2022 represents an important turning point for a variety of economic and capital market assumptions, posing new challenges for investors to consider in the year(s) ahead. Higher inflation and interest rates, lower global growth, and an active Federal Reserve combined to produce elevated market volatility in the first quarter of 2022. Indeed, recession risks are on the rise for Europe, with the U.S. growth outlook increasingly in question. Equity investors are sure to closely watch 1Q earnings commentary to assess the early impact of war-driven disruptions on company-specific fundamental trends.

In contrast to the recent Covid 19 experience, the Federal Reserve is unlikely to reduce interest rates to offset any near-term U.S. growth concerns. In attempting to combat elevated inflationary pressure, the Federal Reserve and other global central bankers plan a series of interest rate increases extending into 2023. It is only a matter of how far, how fast, and how long these actions will persist. While these intended actions are known and to a degree priced into capital market prices, historically, higher volatility accompanies a lift in interest rates.

In this period of heightened uncertainty, investors are indicating a preference for participation in companies with a history of strong cash flows, dividend growth characteristics and operating resilience through an economic cycle. A commitment to higher quality equities with strong profiles remains a consistent hallmark of

Bahl & Gaynor’s investment philosophy.

We believe that Reliable Income = Reliable Outcome®.

The Intersection of Geopolitical Events with the Capital Markets

The military actions of early 2022 are intensifying and extending the supply shocks and logistical delays evident in the pandemic period. The OECD (Organization for Economic Cooperation) estimates global growth will be 1.1% lower and inflation 2.5% higher solely due to the Russian-Ukrainian war. While the direct revenue exposure of the S&P 500’s revenues attributable to Russia aggregate to approximately 1%, revenue exposure linked to Europe is much greater at 14% of the total. Not surprisingly, mid-March readings show a notable decline in demand from this important export partner. The S&P 500’s revenue exposure to China (7%) is also a slowdown risk as this geography is currently under pressure due to Covid-related lock downs. Accordingly, it is increasingly possible that lower foreign derived company revenues and margins will pressure full year 2022 S&P 500 earnings estimates. Additionally, while the U.S. economy continues to report a variety of credible signs of strength, higher energy costs and supply constraints remain powerful offsets to first quarter operating profitability for selected domestic companies.

Apart from immediate events, it appears that Russian aggression will trigger higher defense budgets in Europe, a focus on global energy security and a renewed emphasis on semiconductor manufacturing capacity in the U.S. Additional geopolitical shifts influencing future global economic relationships are possible as China’s and Saudi Arabia’s roles are yet unknown and perhaps not fully sympathetic to U.S. interests. While we are hopeful for a near term diplomatic solution, the full economic impact of war in Ukraine cannot be determined at this time. Coupled with a reshuffling of global political alliances, sustained supply disruptions of key strategic materials and elevated rates of inflation appear to be solid assumptions over the full year 2022 period.

Just the Basics: Consumers Facing Higher Food, Shelter, and Energy Costs

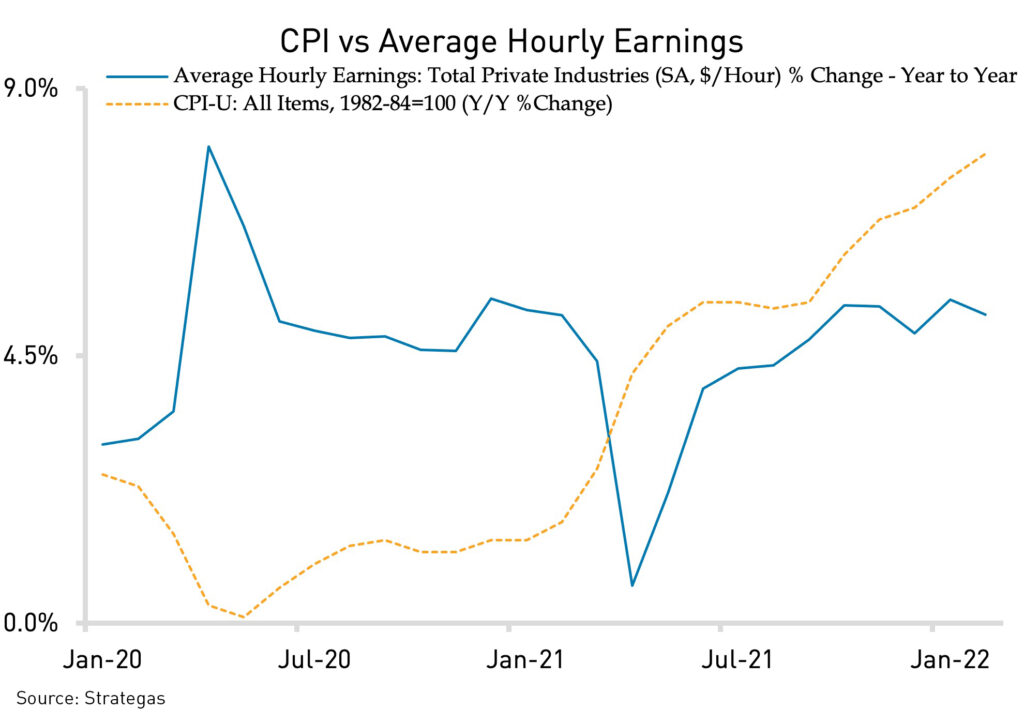

The February Consumer Price Index increased 7.9% year over year, a 40-year high, as a continued mismatch between strong demand and war-driven circumstances intensify prior Covid-driven supply shocks.

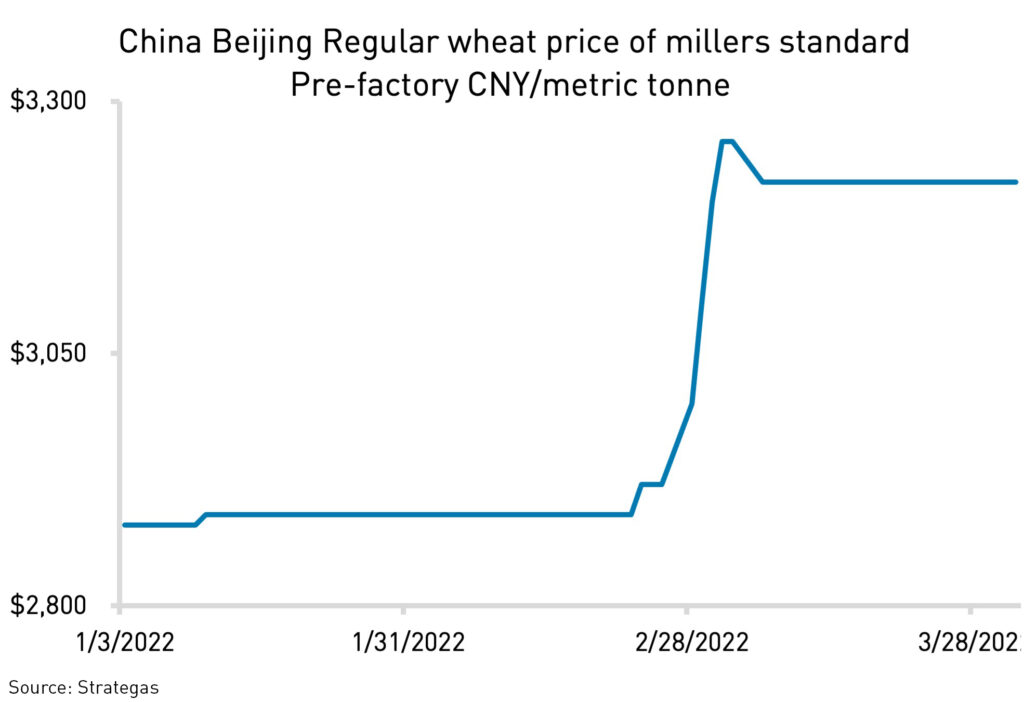

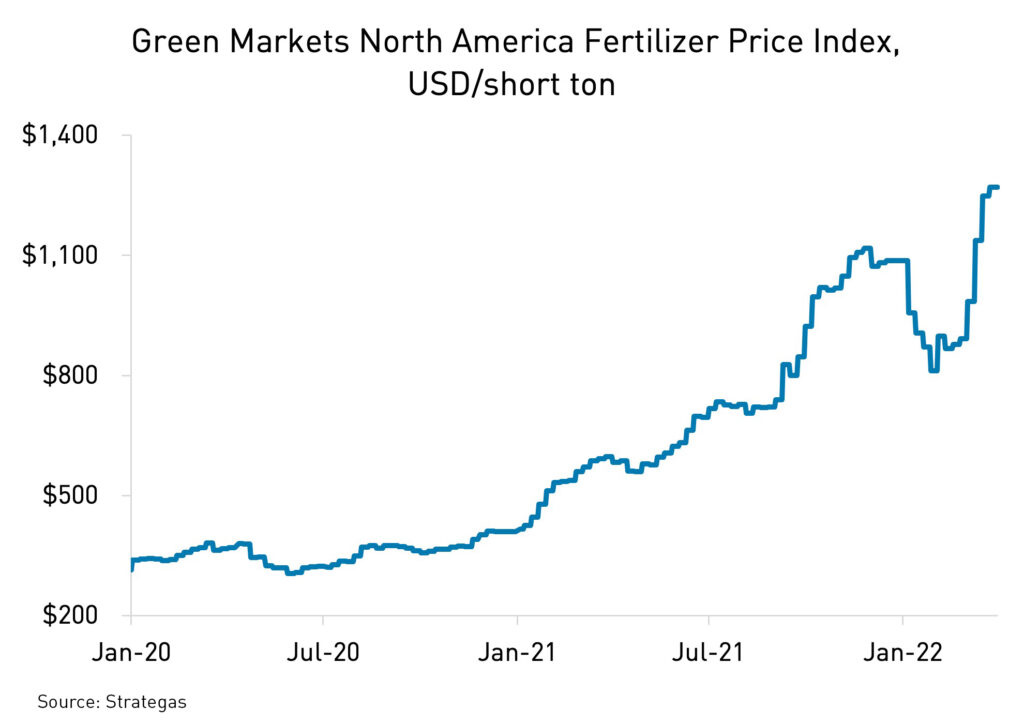

Energy price increases are a “perfect storm” combination of strong global demand, incremental supply disruptions, sanctions and a shortage of rig operators and truck drivers as many have left the industry for higher pay. Nationally, rents are 17% higher vs. year earlier levels. Russia is the world’s largest producer of agricultural fertilizer; export limitations plus higher natural gas prices, a key component of fertilizer manufacturing, are taking costs to record levels.

Additionally, combined Russian and Ukrainian global wheat and corn exports account for 28% and 16% of global totals respectively. Sustained supply disruptions in both fertilizer and commodities are anticipated to only add to food inflation. In February, grocery prices were 8.6% higher domestically, the largest annual increase since April of 1981. Even if a diplomatic solution emerges in the Ukrainian/Russian war, sanctions are likely to remain in place restricting key food and commodities from the global marketplace. Continued accelerated energy price and wage increases in March strongly suggest persistent elevated inflation readings over the next several quarters.

Wage growth of 5.6% and an unemployment rate under 4% are positives for the U.S. consumer and serve as constructive offsets to the recent surge in prices. However, consumer purchasing power is falling behind incrementally, resulting in an after-inflation adjusted wage cut of 2.3% to date. In response, consumer confidence readings are now flashing signs of caution.

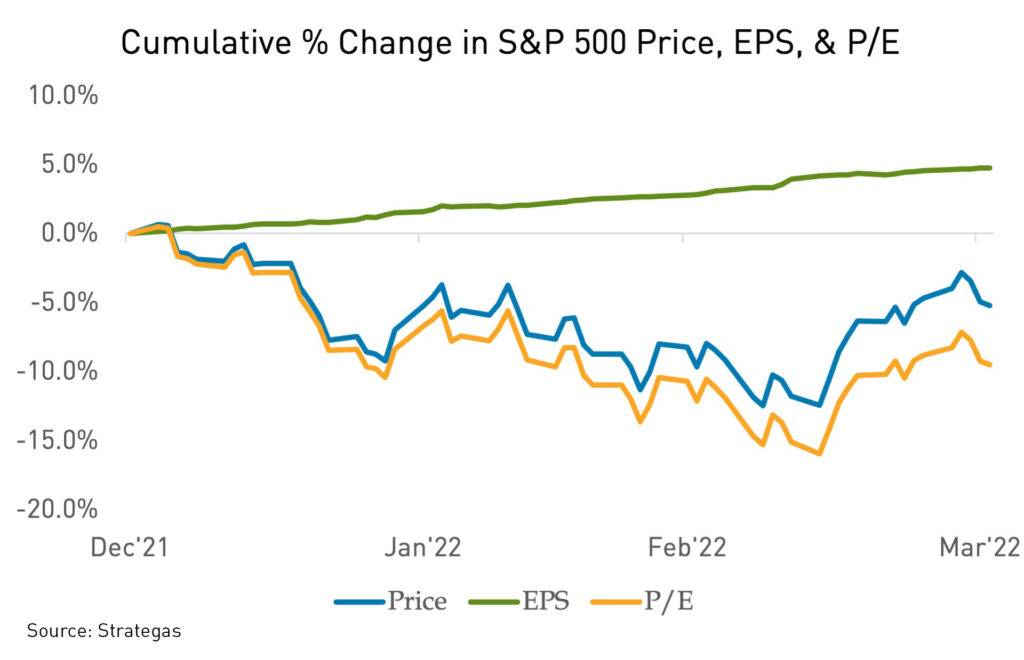

Higher inflation also works to erode equity price valuations. Price to earnings (P/E) ratios, a valuation tool used to assess the degree to which stocks are expensive at a given level of earnings, historically have moved lower in response to higher inflationary readings. Even when earnings for the equity market continue to rise, a lower trending P/E ratio provides a powerful headwind for stocks prices, usually resulting in lower market values.

A Port in the Storm

The generation of a rising income stream, downside protection and a competitive risk adjusted total return over a full market cycle remain central objectives of Bahl & Gaynor’s investment philosophy. In periods of capital market volatility, these attributes are highly valued as stability and reliability are appealing investor outcomes. Unanticipated “black swan” events and volatility are inevitable and indigenous to the long-term investor experience. The Bahl & Gaynor investment philosophy stabilizes account values relative to market benchmarks utilizing cash rich, dividend paying equities diversified across the S&P 500’s eleven economic sectors. A rising stream of inflation-fighting dividend income in times of higher inflation serves to protect and maintain client spending power, an important consideration currently.

We thank our clients and partners for their continued trust in the Bahl & Gaynor’s time-tested investment philosophy during this period of uncertainty and capital market transition.