Thought Leadership

Bahl & Gaynor Insight: February 2025

There has been significant and varied debate regarding the contours of the Trump Administration’s approach to trade policies with trading counterparts. Over the weekend, the market received its first glimpse of actual policy implementation.

WHAT WE KNOW

- The Trump Administration levied a 25% tariff on Canada and a 10% tariff on China. A 25% tariff on Mexico was also announced but suspended for one month following a discussion between President Trump and Mexico’s President, Claudia Sheinbaum.

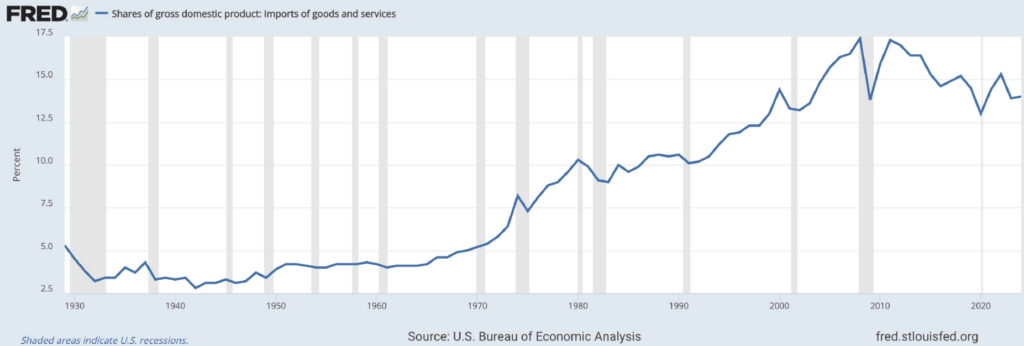

- Canada, Mexico, and China comprise approximately 45%1 of U.S. imports, though the U.S. is a relatively closed economy with only 14%2 share of GDP derived from imports of goods and services.

- Canada has already responded by imposing 25% tariffs on select U.S. goods3. China4 has vowed retaliatory measures against the U.S., but with no details yet at the time of publication.

WHAT WE DON’T KNOW

- The ultimate impact of these new trade policies on all the economies involved is still unknown. Though there can be estimates of immediate economic impact, there is likely a material negotiation component to the trade policy equation that is not yet quantifiable.

- As a parallel example, our recent commentary on DeepSeek’s developments in the artificial intelligence (AI) infrastructure space shows how the market’s near-term reaction to large thematic shifts can vary. This parallel development reinforces the expectation that new trade policy implementation may induce additional market volatility.

- Since the ultimate structure and economic impact of new trade policies are still unclear, it’s even harder to assess the lasting fundamental impact on business and their investors.

BAHL & GAYNOR VIEW

- As an active, fundamental, dividend growth investor, Bahl & Gaynor bases its active portfolio management decisions on quantifiable and durable impacts to company fundamentals that can alter the path of client outcomes (such as the growth profile of portfolio dividend income growth).

- A cornerstone of our fundamental approach is seeking out portfolio companies that we believe possess ample financial, strategic, and tactical flexibility to adjust their business models as the business environment changes. This bears fruit to our investors by protecting the vital mechanism of capital compounding.

- Trade policy changes, particularly tariffs that may prove to be a negotiating tactic, can take time to exert an impact, and that impact may ultimately be expressed in unexpected ways (weakening some business models, while strengthening others).

BOTTOM LINE

As active investors, we do not believe the market is perfectly efficient in pricing the constant parade of news unfolding in the public sphere. We do believe the market is prone to overreact around major news events because it is comprised (at least in part) of human participants with fickle temperament. This can create asset mis-pricings in both directions that drive portfolio opportunities within our disciplined process. We will continue to assess the evolving narrative of trade policy, with a particular focus on the opportunities that are uncovered via our fundamental analysis.

Published on 2/3/2025.

The information provided herein is for informational purposes only and does not constitute an offer or solicitation to buy or sell any securities. The views expressed reflect the opinions of Bahl & Gaynor as of the date of this communication and are subject to change. Bahl & Gaynor assumes no liability for the interpretation or use of this report.

1Source: Evercore/ISI, 2025.

2U.S. Bureau of Economic Analysis, Shares of gross domestic product: Imports of goods and services [B021RE1A156NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/B021RE1A156NBEA, February 2, 2025.

3Source: BBC, 2025.

4Source: Bloomberg, 2025.

Gross Domestic Product (GDP) refers to the total monetary value of all goods and services produced within a country’s borders during a specific period, typically measured annually or quarterly. It serves as a key indicator of a nation’s economic health and performance. GDP can be calculated using three primary approaches: Production Approach: Measures the value of all goods and services produced. Income Approach: Sums up total income earned by individuals and businesses, including wages and profits. Expenditure Approach: Adds up consumer spending, business investments, government spending, and net exports (exports minus imports). GDP is often expressed in nominal terms or adjusted for inflation (real GDP) to provide a more accurate measure of economic growth over time.

BGC20250203-671