Financial Planning

Inflation Impact: Plan Now for Later

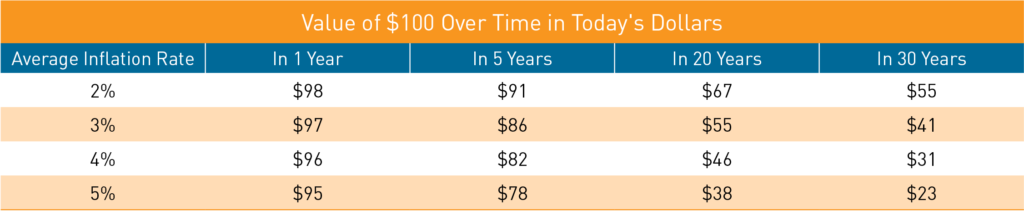

Wall Street & news outlets are buzzing about inflation; you’ve surely noticed rising prices at the gas station, grocery store, and especially if you’re in the market for a big-ticket item like a house or a car. Inflation impacts all of us; it has influence not only on the price of goods and services we purchase but also on our overall financial health. Rising prices can sneak past us over short periods of time, but you may be surprised by the dramatic impact over several years. Take a look at what $100 today will be worth over time at varying levels of inflation:

In the short term, inflation’s eroding effects may appear small. Over the course of decades however, it is hard to ignore. In a culture focused on living for today, looking ahead 20-30 years may seem like overkill, but it’s not when you consider we are living longer1 and healthier in our later years. Our next life chapter following retirement could span several decades. Inflation’s quiet ability to slash today’s dollars over time makes it essential to consider stable income sources post-retirement. Further, while the inflation rate in the United States has averaged 3.23% for more than a century2, retirees are more likely than the average consumer to spend money on goods and services that increase in price at a faster rate than other expenditures. We’re talking in particular about healthcare3, housing, travel, supporting adult children and education expenses for grandchildren.

How do we protect ourselves? With careful planning, there is hope:

![]()

A crucial component of a sound financial plan is being honest about spending goals. A recent study by Global Atlantic suggests two out of five retirees spent more in retirement than anticipated.4 A review of spending with your trusted advisor is a great first step, coupled with honest conversations around what you envision life to look like in the years ahead. Regular check-ins and the willingness to make spending adjustments are key to ensuring you live life to the fullest without running out of resources.

![]()

Investing does not stop at retirement. Understanding how your various assets will support your lifestyle increases confidence in your future and decreases worry. We encourage people to know what their resources are when compared to what they need and want. Then we can evaluate how to reach your goals using a dependable and disciplined investment strategy. While past performance is no guarantee of future results, historically, stocks have provided the best inflation adjusted return relative to any other asset class. Constructing a portfolio that maximizes stock ownership while staying within acceptable levels of risk can offer the best hedge against inflation.

![]()

Some people address inflation by continuing to work. Often, they are following a life-long passion in a completely different industry. Retirement age doesn’t have to be 65, especially if you want to pursue interests that pay! When considering a second (or third) career, we encourage conversations with your planning and investment advisors to discuss strategies that maximize social security and/or other pension income.

![]()

The only constant in life is change. There will be unknown expenses. There will be down markets. There will be shifts in Washington that lead to different rules and regulations. Keep open the lines of communication with your advisors on planning, investments, tax and legal considerations. We believe it’s important to control what you can control; great communication, collaboration and the ability to change direction when needed.

As William Jennings Bryan once stated, “Destiny is no matter of chance. It is a matter of choice. It is not a thing to be waited for, it is a thing to be achieved.” At Bahl & Gaynor we believe achieving financial security in retirement means making wise choices now. Our Financial Planning team can work with your advisors to customize a plan using our dividend growth philosophy. Our goal is to provide a growing stream of income… ahead of inflation… to protect your purchase power now and your retirement plans later.

To get started on your plan, talk to your Bahl & Gaynor portfolio manager today.

Sources

1 Assumes average retirement age of 65, life expectancy based on 2012 IAM Basic Tables. https://bit.ly/36nvDw6

2 Tradingeconomics.com & US Bureau of Labor Statistics https://bit.ly/36pvmca

3 Centers for Medicare and Medicaid Services https://go.cms.gov/2TSihW3

4 https://bwnews.pr/3i99bw2