Our Approach

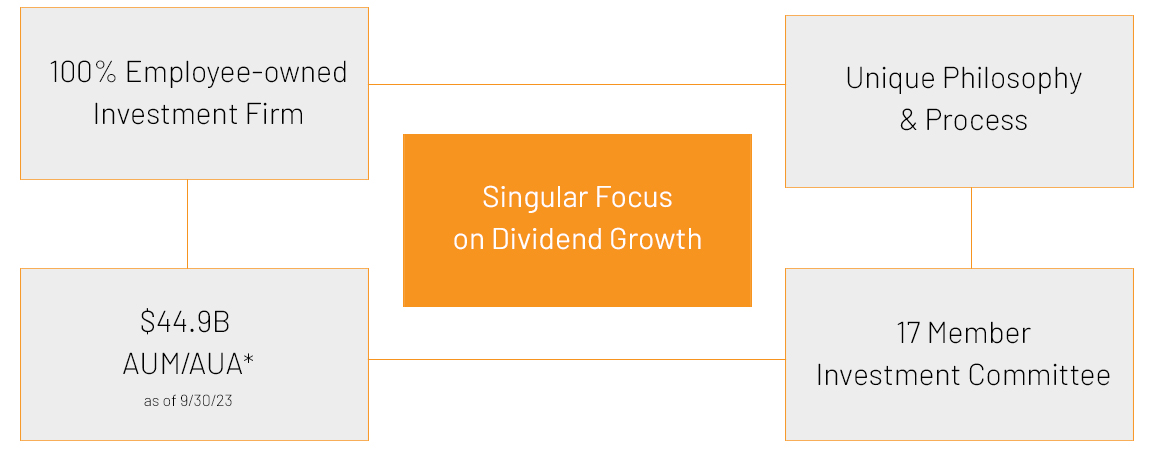

Since 1990, Bahl & Gaynor has pursued a unified fundamental investment philosophy predicated on long-term ownership of high-quality businesses that we believe are uniquely capable of compounding capital and dividends at attractive growth rates.

Our Strategies

Income Growth

Seeking attractive current and growing income with downside risk protection and strong risk-adjusted returns.

Large Cap Quality Growth

Seeking accelerated income growth characteristics.

Dividend Growth ESG

Combining our dividend- growth philosophy with ESG integration.

smig® – Small/Mid Cap Income Growth

Applying our core income growth philosophy to small and midcap companies.

Small Cap Quality Growth

Seeking attractive risk- adjusted return opportunities in small dividend-paying companies.

Schedule a Meeting

Subscribe to our newsletter to get to know us, or connect directly with one of our experienced advisors below to learn how our capabilities can help you achieve your goals.

Our Team

Our deep and tenured team works closely with advisor partners to deliver unique and competitive dividend-focused investment strategies.

Latest Insights

Market Concentration: At The Tipping Point?

Investors are paying more attention to the concentration of the largest public companies in market…

Learn More

Big Reasons to Think Small: Volume II

In December 2023, Bahl & Gaynor published “Big Reasons to Think Small” which took an…

Learn More

The ABC’s of active ETF’s

The ETF market has experienced significant growth and advancements over the past decade. Once synonymous…

Learn More